Frequently Asked Questions

- General Preliminary FIRM Questions

- Appeals and Comments

- Vertical Datums

- Flood Insurance

- Building and Construction Requirements

- Advisory Base Flood Elevation (ABFE) Maps*

- Preliminary Work Maps*

*For most communities, ABFE maps and preliminary work maps have been replaced by preliminary Flood Insurance Rate Maps (FIRMs) as the most recent flood hazard information available from FEMA.

General Preliminary FIRM Questions

Why is the Flood Insurance Rate Map (FIRM) being updated for my community?

Flood risk can change over time. Natural changes in stream channels, beach erosion, and man-made changes like development can decrease or increase the risk. The New York/New Jersey coast is one of the most populated coastlines in the nation, and a large amount of development has happened since most effective FIRMs for the area were produced.

Since that time, there have also been advancements in the methodologies, technologies, and information available to map coastal flood hazards. The coastal flood study underway will use the most current and accepted methods and information available to map coastal flood hazards on the new FIRMs.

Who is responsible for developing the coastal flood study and the new FIRMs?

The coastal flood study is a shared effort among FEMA, its mapping partners, including the New Jersey Department of Environmental Protection, the New York City Mayor’s Office of Sustainability, and the U.S. Army Corps of Engineers, and other state agencies and the area’s coastal communities which provide input throughout the process.

Will the preliminary FIRMs affect flood insurance rates and requirements?

The preliminary FIRMs will not immediately affect flood insurance rates or the requirement to purchase Federal flood insurance in high risk flood areas. Only the effective FIRM, which has been officially adopted by your community officials, can be used to rate flood insurance policies or require the purchase of flood insurance.

Are the effects of Sandy taken into account on the preliminary FIRMs?

Because no storm affects all areas in the same way, FEMA does not take into account the effects of specific storms like Sandy when producing flood hazard information. Instead, FEMA’s flood studies take into account a long-term projection of flood hazards based on the most current and accepted models, technology, and information available.

Has a preliminary FIRM been issued yet for my community?

Preliminary FIRMs for Westchester County, New York, New York City and Atlantic, Bergen, Burlington (Atlantic Coast only), Camden, Cape May, Cumberland, Essex, Gloucester, Hudson, Middlesex, Monmouth, Ocean, Union, and Salem Counties, New Jersey, have been released and are available through the View Preliminary Maps & Data page.

How can I view the preliminary FIRMs?

You can view the preliminary FIRMs online through tools on the View Preliminary Maps & Data page. The maps are also available through your community’s local map repository (often, the planning or zoning office). Online tutorials are available from FEMA to help users understand how to read the FIRM and FIS Report.

When will the preliminary FIRMs be finalized?

Typically it takes 18 to 24 months to finalize the preliminary FIRM after it is released, but it can take longer. Learn more about the required steps in the mapping process on the What Happens Next? page.

I don’t agree with the information shown on the preliminary FIRM. How can I provide my comments to FEMA on the maps?

After the preliminary FIRMs are issued, a series of CCO meetings and public open houses will be held by FEMA during which community officials and the public can ask questions and provide their comments about the maps. The times and dates of all meetings will be posted on the project calendar of this website.

FEMA also provides a 90-day appeal period for all new or modified flood hazard information on the preliminary FIRM. Interested parties can submit scientific or technical information that proves the flood hazard information is not correct through the end of the appeal period. Comments on other aspects of the FIRM such as road name and corporate limit changes will also be accepted. Learn more on the Appeals & Comments page.

What will the flood hazard information on the FIRM be used for once finalized?

An effective FIRM is a map produced for a community participating in the National Flood Insurance Program that has been officially adopted by that community. The flood zones and Base Flood Elevations (BFEs) shown on the FIRM are used to determine flood insurance rates and requirements. Communities also use the FIRMs to manage development and to make other floodplain management decisions.

How can I look up information from my community’s effective FIRM?

You can view the effective FIRM at the FEMA Flood Map Service Center. Your local Community Map Repository (often the planning and zoning office) also has copies of the FIRMs. For specific properties, you can use the “What is My BFE?” address lookup tool to compare information from the effective and preliminary FIRMs.

Who should I talk to if I have questions about the coastal flood study or the FIRMs?

The FEMA Map Information eXchange is available to assist you by phone toll-free at 1-877-FEMA-MAP (1-877-336-2627) or through e-mail or Live Chat service. Visit our Contacts page to see a list of contact information organized by topic.

I am rebuilding my house. Should I be using the Base Flood Elevation (BFE) information from the preliminary FIRM or the effective FIRM to determine how high I need to build?

New Jersey residents: New Jersey law requires the lowest floor of residential buildings to be constructed at least one foot above the updated flood hazard data elevation (i.e., the BFE shown on the preliminary FIRM, if available) or the effective BFE, whichever is higher. However, some communities may require elevating even higher. For new construction or substantially damaged buildings, you should consult with your community’s building officials to determine the elevations and construction requirements which apply.

New York City residents: New York City is also using preliminary FIRM information for floodplain development standards. Learn about specific City requirements on New York City’s FEMA Flood Map Update page or contact the New York City Department of Buildings.

Appeals and Comments

Please note that the appeal period has now ended for most communities that are affected by the coastal flood study. Check dates for your community on the Appeal Period Dates page.

What is the appeals process and how does it work?

The appeals process is part of the regulatory mapping process outlined in Title 44, Chapter I, Part 67 of the Code of Federal Regulations. Whenever FEMA issues preliminary FIRMs that involve changes to flood hazard information, a statutory 90 day appeal period is required. FEMA starts the appeals process by:

- Publishing a notice in the Federal Register;

- Notifying the affected communities by letter of the start of the appeal period;

- Publishing a news release twice in a prominent local newspaper.

During the appeal period anyone can submit information (first reviewed by their local officials) that shows the proposed flood hazards or other information on the preliminary FIRM or in the FIS report are not correct. Local officials then provide this information to FEMA for review. If needed, the preliminary FIRM will be updated before it is finalized.

What is considered an appeal?

To be considered an appeal, a submittal must:

- Include data that shows the proposed flood hazard information (e.g. new or modified Special Flood Hazard Area zones or boundaries, Base Flood Elevations, base flood depths, and/or floodway boundaries) is scientifically or technically incorrect;

- Include the needed revisions to the FIRM and/or FIS report (e.g. boundaries of revised floodplains);

- Be received during the statutory 90 day appeal period.

The designation of a submittal as an appeal provides certain appellant rights, including the opportunity for the affected community to have data reviewed by a Scientific Resolution Panel.

What is a comment?

The term comment is used for any submittal that does not meet the requirements outlined for appeals above. This includes feedback about road names, jurisdictional boundaries, or other base map features or concerns about proposed flood hazard information that don’t meet the requirements for an appeal.

Who can submit an appeal or comment?

Anyone can submit an appeal or comment. However, all submittals must be reviewed by the appropriate community official before FEMA reviews the information.

I believe my home has been incorrectly included in the revised floodplain shown on the preliminary FIRM. Should I submit an appeal?

Due to map scale limitations, changes to individual lots or structures typically cannot be shown on the FIRM. Therefore, the appeals process typically cannot be used to remove such a property from the floodplain. Instead, FEMA makes available the Letter of Map Amendment (LOMA) process for property owners who believe their home or property has been inadvertently included in the floodplain. LOMAs officially change the zone designation on an effective FIRM, not a preliminary FIRM, so you’ll need to wait until the new FIRM is finalized. You can submit your request online – learn about how the process works and what information you need to submit through FEMA’s LOMA webpage.

I want to appeal the flood hazard information on the preliminary FIRM. What information do I need to submit?

You will need to submit information that shows that the preliminary flood hazard information is scientifically or technically incorrect. Acceptable data could include:

- Alternative coastal, hydrologic, and hydraulic analyses to support a change to BFEs, base flood depths, flood zone boundaries or designations, or other flood hazard information;

- More detailed or accurate topographic (elevation) data in support of flood hazard boundary changes;

- Revised flood zone boundaries, floodway delineations, and/or Flood Insurance Study (FIS) report tables and profiles (if applicable) showing the resulting changes to the preliminary FIRM and FIS report must also be provided in digital format.

Supporting data must also be certified by a registered Professional Engineer or Licensed Land Surveyor as appropriate. More detail about types of data to submit is available on pages 5-11 of FEMA’s Criteria for Appeals of Flood Insurance Rate Maps. (Please note that the FEMA Standards for Flood Risk Analysis and Mapping publication (see pages 74 – 75) serves as the authoritative policy and standards documentation available from FEMA and takes precedence over other guidance documents. The Criteria for Appeals of Flood Insurance Rate Maps publication supplements the FEMA standards and serves as the most detailed source of guidance related to appeal submittal requirements and processing.)

Where can I get the technical data used to prepare the preliminary FIRMs?

Technical data and reports are available online at these locations:

- Field reconnaissance, storm surge, and wave height data for the Atlantic coast; organized by state/county

- NY/NJ Coastal Storm Surge Study Technical Reports (summarize the new storm surge modeling to support the coastal flood study for the Atlantic coast)

- U.S. Army Corps of Engineers Coastal Storm Surge Study reports for the Delaware River coastal flood study (affects Salem, Gloucester, and Camden Counties in New Jersey).

- FEMA’s Atlantic Ocean and Gulf of Mexico Coastal Guidelines Update provides coastal methodology guidelines for analyzing and mapping coastal flood hazards. You can get more information about FEMA mapping standards and guidance through FEMA’s website.

When can I submit my data/feedback regarding the preliminary FIRM?

Feedback can be provided any time after the release of the preliminary FIRMs until the end of the 90-day appeal period. However, please note that the appeal period has now ended for most communities that are affected by the coastal flood study. Check dates for your community on the Appeal Period Start and End Dates page.

How do I submit my data/feedback regarding the preliminary FIRM?

FEMA Region II has developed the Preliminary Flood Map Feedback Portal which allows community officials and the public to submit and track appeals and comments online during the appeal period. The Portal also provides community officials with the ability to review requests submitted by the public prior to FEMA review, as outlined in National Flood Insurance Program regulations. Step by step guides for community officials and the public, and other help resources are available on the Portal to walk you through the process.

Use of the Portal to submit feedback on the preliminary FIRMs is encouraged but not required. It is intended to make the process for submitting and tracking appeals and comments simpler and easier for everyone. You can learn about alternate ways to submit your feedback in the Submissions fact sheet.

The Portal can be used by members of the public and community officials providing feedback on preliminary FIRMs for the following communities:

New York Communities

New York City

Westchester County, NY

New Jersey Counties:

Atlantic County

Bergen County

Burlington County

Cape May County

Cumberland County

Essex County

Hudson County

Middlesex County

Monmouth County

Ocean County

Salem County

Union County

What will happen after I submit an appeal or comment?

Following review by community officials, FEMA will review the information and prepare a response that will state 1) if a change to the preliminary FIRM is warranted based on the information submitted, 2) if more information is needed to complete the review, or if a change is not warranted. A 30 day period following resolution of the concern is also provided for appeals during which a response to FEMA’s resolution may be submitted by the community and/or original requestor. Following the resolution of all appeals and comments, FEMA will move forward with finalizing the FIRM and FIS report.

What is a Scientific Resolution Panel?

Scientific Resolution Panels (SRPs) are independent panels of experts in hydrology, hydraulics, and other sciences established to review conflicting scientific and technical data and provide recommendations for resolution. An SRP is an option for a community after FEMA and a local community have been engaged in a collaborative consultation process regarding data submitted during the appeal period without a mutually acceptable resolution. More information is available through FEMA’s SRP fact sheet.

Vertical Datums

What is a Vertical Datum?

A vertical datum is a base measurement point (or set of points) from which elevations are determined. Historically, the standard datum used by the federal government was the National Geodetic Vertical Datum of 1929 (NGVD 29). However, the North American Vertical Datum of 1988 (NAVD 88) is now the national standard. There are also many other different vertical datums available. For example, local vertical datums have been established for each of the five boroughs of New York City:

• Bronx Datum;

• Brooklyn Datum;

• Manhattan Datum;

• Queens Datum; and

• Richmond Datum.

Why are there so many vertical datums?

Over the years, different datums have been established based on the technology and information on hand and the need for a vertical reference point in a given area. The use of Global Position System (GPS) satellites to measure elevations and observations from coastal gages have helped government agencies develop new, more accurate datums, such as NAVD 88, which allow for the better comparison of elevations.

Why does it matter which vertical datum an elevation is referenced to?

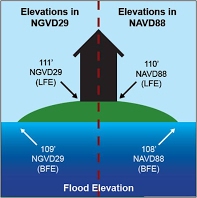

Elevation values based on different vertical datums cannot be used together directly since they are based on a different vertical reference point (See graphic below). When comparing the preliminary FIRM elevation data released by FEMA with elevation information on Elevation Certificates and other documents from different sources, care must be taken to ensure all elevations are in the same datum. If they are not the same, a conversion factor must be applied so that the values are referenced to the same datum before they are used. Failure to do so can result in improper structure design (e.g., building at the wrong elevation) which can have serious implications in terms of complying with community and state building requirements. Flood insurance rates can also be impacted.

Why is FEMA using NAVD88 for the updated maps?

NAVD88 is more compatible with modern surveying and mapping technologies like Global Positioning Systems (GPS). It also is more accurate than the previous national vertical datum, NGVD29.

What do I do if I have elevation information for my house but the information is not in the NAVD88 datum?

When you have elevations referenced to different datums, you will need to apply a conversion factor in order to properly compare the two. The conversion factor needed will depend on the original datum an elevation is referenced to, and the datum you are converting the elevation to.

Is there a table of conversion factors for the various New York City datums available?

Yes. Please see the table below.

New York City Datum Conversion Table

Find the datum conversion factor value in the table below by locating the current datum of your elevation data in the top row and the datum you’d like to convert to in the left column. Then find the conversion factor value at the intersection of those fields.

Table Usage Instructions: Step 1: Find the datum your elevations are currently referenced to in the row to the right.Step 2: Find the datum you would like to convert your elevations to in the column below. Step 3: At the intersection of those fields, you will find the conversion factor needed to convert your elevations.

| NAVD88 Datum | NGVD29 Datum | Bronx Datum | Brooklyn Datum | Manhattan Datum | Queens Datum | Richmond Datum | |

|---|---|---|---|---|---|---|---|

| NAVD88 Datum | N/A | -1.1 feet | +1.508 feet | +1.447 feet | +1.652 feet | +1.625 feet | +2.092 feet |

| NGVD29 Datum | +1.1 ft | N/A | +2.608 feet | +2.547 feet | +2.752 feet | +2.725 feet | +3.192 feet |

| Bronx Datum | -1.508 feet | -2.608 feet | |||||

| Brooklyn Datum | -1.447 feet | -2.547 feet | |||||

| Manhattan Datum | -1.652 feet | -2.752 feet | |||||

| Queens Datum | -1.625 feet | -2.725 feet | |||||

| Richmond Datum | -2.092 feet | -3.192 feet |

As an example, using the table above, if you have a first floor elevation of 6.0 ft (Richmond Datum) for a property in Staten Island (Richmond County) then the elevation in NAVD88 would be: 6.0 ft + 2.092 feet = 8.092 ft. Similarly, if you had an elevation of 8.0 feet (NAVD88) for the same property in Staten Island the elevation in the Richmond Datum would be: 8.0 ft – 2.092 ft = 5.908 feet.

Is there a table of conversion factors available to compare updated FEMA flood hazard data with the effective FIRMs in New Jersey?

In New Jersey, conversion factors (please see table below) are needed only for Atlantic, Bergen, Burlington, Cape May, Salem, Cumberland, and Union Counties in New Jersey as the effective Base Flood Elevations (BFEs) shown on these FIRMs are in NGVD29. For other counties in New Jersey affected by the coastal flood study, the effective BFEs shown on the FIRMs are in NAVD88. Thus no conversion factor is needed to compare the updated flood hazard data released by FEMA and the effective FIRMs for those counties.

I have elevation data in datum NGVD29 for:

| Atlantic Co. | Bergen Co. | Burlington Co. | Cape May Co. | Union Co. | Salem Co. | Cumberland Co. | |

|---|---|---|---|---|---|---|---|

| I want elevations in NAVD88 | -1.2 feet | -1.0 feet | -1.3 feet | -1.3 feet | -1.0 feet | -1.0 feet | -1.1 feet |

OR

I have elevation data in datum NAVD88 for:

| Atlantic Co. | Bergen Co. | Burlington Co. | Cape May Co. | Union Co. | Salem Co. | Cumberland Co. | |

|---|---|---|---|---|---|---|---|

| I want elevations in NGVD29 | +1.2 feet | +1.0 feet | +1.3 feet | +1.3 feet | +1.0 feet | +1.0 feet | +1.1 feet |

Information about datum conversions for Middlesex, Monmouth, Hudson and Ocean Counties is provided in the table below. However, no conversion factor is needed to compare the updated flood hazard data released by FEMA and the effective FIRMs for these counties since both are referenced to NAVD88. However, elevations contained in other maps and documents may reference NGVD29 and require conversion.

I have elevation data in datum NGVD29 for:

| Middlesex Co. | Monmouth Co. | Hudson Co. | Ocean Co. | |

|---|---|---|---|---|

| I want elevations in NAVD88 | -1.1 feet | -1.1 feet | -1.1 feet | -1.2 feet |

OR

I have elevation data in datum NAVD88 for:

| Middlesex Co. | Monmouth Co. | Hudson Co. | Ocean Co. | |

|---|---|---|---|---|

| I want elevations in NGVD29 | +1.1 feet | +1.1 feet | +1.1 feet | +1.2 feet |

As an example, using the table above for a location in Burlington County, if you have a first floor elevation of 6.0 ft (NGVD29) for a property, then the elevation in NAVD88 would be: 6.0 feet – 1.3 feet = 4.7 feet. Similarly, if you had an updated elevation of 3.0 ft (NAVD88) for the same property in Burlington County, the elevation in NGVD29 would be: 3.0 feet + 1.3 feet = 4.3 feet.

Are there any tools on the web to help convert between datums?

Yes, the National Geodetic Survey has developed a tool for advanced users to convert between NGVD29 and NAVD88. This tool, called VERTCON, can be found at http://www.ngs.noaa.gov/cgi-bin/VERTCON/vert_con.prl.

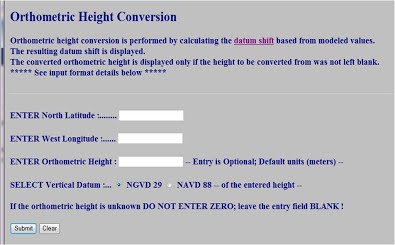

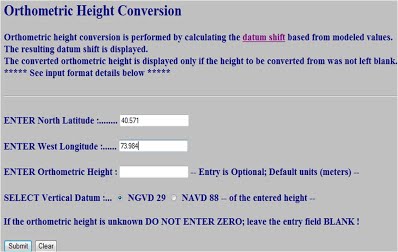

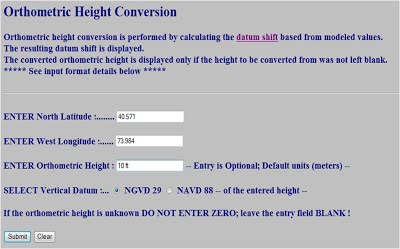

How does one use the VERTCON datum conversion tool?

The National Geodetic Survey provides an online tool to help users convert between the datums for any location. A step-by-step guide is provided below.

1) Access the datum conversion online tool.

2) Enter the North Latitude and West Longitude positions. List both positions as positive numbers. Positions may be entered in any of the following three formats:

• degrees, minutes and decimal seconds ( xxx xx xx.xxx)

• degrees and decimal minutes ( xxx xx.xxx)

• decimal degrees ( xxx.xxxxx)

Note: There MUST be one or more blanks between entry fields. Decimals can be keyed commensurate with the field’s precision, but are not required.

3) Enter the height to convert. Note: The default unit is meters. Enter “ft” after the number to show the elevations and conversion factor in feet.

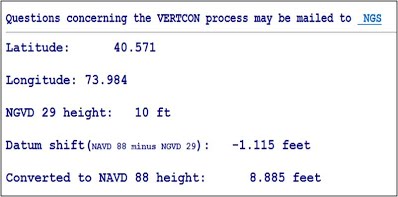

4) Select the vertical datum of the height entered (i.e., this example is converting 10 ft NGVD29 into NAVD88; therefore, NGVD29 was chosen).

5) Click Submit. The result reveals both the conversion factor (-1.115 ft in this example) and what the original elevation height is, once converted to the new datum (8.885 ft NAVD88 in this example).

Where can I find more information about vertical datums?

If additional details are needed, the following resources may be helpful.

• For FEMA’s guidelines regarding vertical datum conversions, are available in Vertical Datum Conversion Guidance.

• Additional information on vertical datums, including the conversion from NGVD29 to NAVD88 at any location, can be found by visiting the National Geodetic Survey website.

Flood Insurance

Am I required to purchase flood insurance?

The Federal requirement to purchase flood insurance applies to structures located in a Special Flood Hazard Area (SFHA) as shown on a community’s effective FIRM, which carry a mortgage backed by a federally regulated lender or servicer. Through the FEMA Flood Map Service Center, you can obtain a community’s effective FIRM to find out the flood zone for a particular location.

Keep in mind that nearly 25 percent of flood insurance claims occur outside of high risk SFHAs. You should consider purchasing flood insurance even if the mandatory requirement does not apply.

How can I get flood insurance?

You can research the purchase of flood insurance through the National Flood Insurance Program’s FloodSmart.gov website, which has tools to help you determine policy coverage, estimate rates, and find an agent based on your address. You also can call FloodSmart toll free at 1-888-379-9531.

How much does flood insurance cost?

A number of factors are considered in determining the premium for flood insurance coverage. They include the amount of coverage purchased; the location, age, occupancy, and design of the building; and, for buildings in SFHAs, the elevation of the building in relation to the Base Flood Elevation as shown on your community’s effective Flood Insurance Rate Map. Premiums are generally higher in areas that are at greater risk of flooding than in those with a lower risk of flooding; therefore, flood insurance rates for structures in SFHAs are higher than rates for structures outside SFHAs.

Contact your insurance agent for a quote. If you do not have an agent, you may locate one by visiting www.FloodSmart.gov.

How will the draft or preliminary FIRM flood hazard data affect my flood insurance rates?

The preliminary FIRM, or other draft maps such as Advisory Base Flood Elevation maps, will not change your current flood insurance premium. Your premium will continue to be based on the official FIRM currently in effect for your community. If your flood zone or BFE will change when the preliminary FIRM becomes effective, consult your flood insurance agent to determine any change to your flood insurance premium.

How does recent flood insurance legislation impact my flood insurance premium?

The Homeowner Flood Insurance Affordability Act of 2014 impacts flood insurance rates under the National Flood Insurance Program in various ways:

- Maintains subsidized flood insurance premiums for older buildings built before the effective date of the community’s first Flood Insurance Rate Map (known as “pre-FIRM”), though the subsidies will be phased out over time.

- Allows buildings constructed in compliance with earlier maps or continuously covered by flood insurance to stay in their original rate class when maps change or properties are sold.

- Maintains property eligibility for lower, preferred-risk rates for the first year after a map change, then increases rates over time beginning in the following year to bring premiums to the full-risk rates.

- Refunds the difference between the subsidized rate and current full-risk rate that policyholders paid when the Biggert-Waters Flood Insurance Reform Act of 2012 implemented an immediate move to property-specific, full-risk rates when pre-FIRM properties were sold or new policies issued.

- Allows policyholders to transfer their flood insurance policy, subsidized rates, and grandfathered rates to new owners with the sale of property.

- Adds a new surcharge to all new and renewed policies.

- Raises the maximum residential deductible limits from $5,000 to $10,000 to help homeowners manage their premium costs.

For more information about the changes, see FEMA’s Homeowner Flood Insurance Affordability Act of 2014 fact sheet.

How can I reduce my flood insurance premium?

By taking steps to reduce your flood risk, you can potentially lower your flood insurance cost. One way to reduce or avoid future flood losses is to raise your building above the Base Flood Elevation. You could reduce your flood insurance premium by 85 percent or more—and save thousands of dollars over the life of your home. You may also be able to reduce your flood insurance premium by relocating your property or building to certain construction standards. For more information about actions you can take, go to the Mitigation Action page.

Policyholders in Community Rating System (CRS) participating communities, which adopt floodplain management activities that exceed the minimum National Flood Insurance Program requirements, receive flood insurance premium discounts up to 45 percent.

Will my flood insurance policy cover the cost to elevate my home?

If your property is insured under the National Flood Insurance Program (NFIP), you may qualify for Increased Cost of Compliance (ICC) coverage. Policyholders in high-risk areas can receive up to $30,000 to help pay the costs of bringing their home into compliance with their community’s floodplain ordinance. You can only file an ICC claim if your community determines that your home has been substantially or repetitively damaged by a flood. This determination is made when you apply for a building permit to begin repairing your home. Substantial damage generally means that repairs will cost 50 percent or more of the building’s pre-damage market value. Funds are available to elevate, floodproof, demolish, or relocate your property.

Why does my insurance agent need an Elevation Certificate, and how can I get one?

Your insurance agent may need an Elevation Certificate to rate your flood insurance policy, using the certificate to confirm the elevation of the lowest floor for properties in A Zones or the lowest horizontal structural member for properties in V Zones. Typically, an Elevation Certificate will be needed only for buildings located in high risk flood zones (e.g., A or V Zones). The NFIP requires that communities keep a record of the elevation of the lowest floor (including the basement) of all new and substantially improved structures. Therefore, if your property is relatively new and is located in a high risk flood zone on the FIRM, your community may have an Elevation Certificate on file that documents your property’s elevation. Contact officials at the building or permitting department to learn whether an Elevation Certificate for your property is available.

If an Elevation Certificate is not available through your community, a land surveyor, engineer, or architect who is authorized by State or local law to certify elevation information can prepare an Elevation Certificate for you.

More information about Elevation Certificates and their use is available through FEMA’s Homeowner’s Guide to Elevation Certificates.

Who should I contact with flood insurance questions?

Contact the National Flood Insurance Program’s FloodSmart representatives toll free at 1-888-379-9531. Many flood insurance questions are also answered at FloodSmart.gov and in the FEMA publication Answers to Questions About the NFIP. You can also contact your flood insurance agent with questions, or locate an agent at FloodSmart.gov.

Building and Construction Requirements

I am rebuilding my house. Should I be using the Base Flood Elevation (BFE) information from the preliminary FIRM or the effective FIRM to determine how high I need to build?

New Jersey residents: New Jersey law requires the lowest floor of residential buildings to be constructed at least one foot above the updated flood hazard data elevation (i.e., the BFE shown on the preliminary FIRM, if available) or the effective BFE, whichever is higher. However, some communities may require elevating even higher. For new construction or substantially damaged buildings, you should consult with your community’s building officials to determine the elevations and construction requirements which apply.

New York City residents: New York City is also using preliminary FIRM information for floodplain development standards. Learn about specific City requirements on New York City’s FEMA Flood Map Update page or contact the New York City Department of Buildings.

How can I determine my current home elevation?

The elevation of your home can be found on your property’s Elevation Certificate if you have one. If you don’t have an Elevation Certificate, FEMA encourages you to consult your local building officials who may have existing elevations from the original building permit for your house. You also can hire a surveyor to determine your current home elevation level.

Are there any grants or funding available to help me repair and/or elevate my home?

If your property is insured under the National Flood Insurance Program (NFIP), you may qualify for Increased Cost of Compliance (ICC) coverage. Policyholders in high-risk areas can receive up to $30,000 to help pay the costs of bringing their home into compliance with their community’s floodplain ordinance. You can only file an ICC claim if your community determines that your home has been substantially or repetitively damaged by a flood. This determination is made when you apply for a building permit to begin repairing your home. Substantial damage generally means that repairs will cost 50 percent or more of the building’s pre-damage market value. More information on ICC coverage is available through FEMA’s ICC webpage.

Both the States of New Jersey and New York have received major disaster declarations and are eligible to apply for Hazard Mitigation Grant Program (HMGP) funds. Property Acquisition (or “buy out”) is an eligible activity under the HMGP, as are other hazard mitigation measures such as structure elevation. Contact your local officials to inquire about HMGP opportunities in your community.

Will revised mapping information affect construction standards?

Communities where revised preliminary Flood Insurance Rate Maps (FIRMs) have been issued may adopt those changes into their local flood damage prevention ordinances as best available information. However, if the currently effective FIRM shows a more restrictive flood hazard zone or Base Flood Elevation (BFE), that information must be used until the new maps become effective.